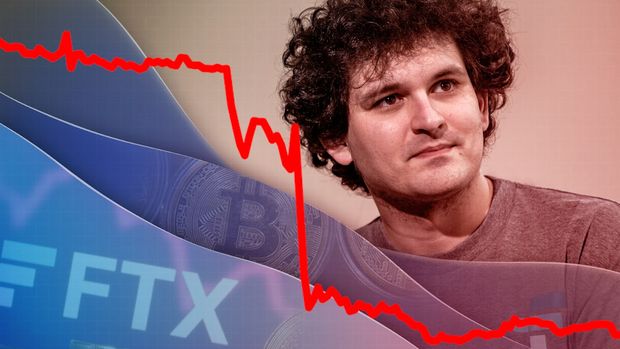

Sam Bankman-Fried, popularly known as SBF and once called JP Morgan of Crypto currency, held a personal fortune of $26B (Rupees 2.1 lakh crores) but is now down to his last $100,000 (80 lakh rupees). His company FTX, once the third largest crypto exchange in the world by volume, filed for bankruptcy protection on Nov 11. And on December 12, Sam was arrested in the Bahamas for the wire fraud, securities fraud and money laundering related charges.

Collapse of FTX is being considered as the Lehman moment for crypto currency. Let’s understand why it happened and what an investor should do or not do to protect their family wealth.

1. Corporate Governance

FTX’s new CEO and Chief Restructuring Officer John Ray III said “The collapse of FTX appears to stem from absolute concentration of control in the hands of a small group of grossly inexperienced and unsophisticated individuals who failed to implement virtually any of the systems or controls that are necessary for a company entrusted with other people’s money or assets.”

Investors need to invest in a company, mutual fund scheme or any investment product or security where corporate governance is absolute and have strict controls, sound policies and procedures, robust processes and systems.

Similarly, investors need to work with an advisor who is independent, capable, experienced, financially sound, has no conflict of interest and has established policies, procedures, controls and processes for advising. And instead of selling an investment scheme or product, advisor should be providing a solution.

Please understand return OF capital is way more important than return ON capital.

2. Importance of Risk Management

SBF during a video interview said “I substantially underestimated what the scale of market crash could look like, and what the speed of what it could look like, and how correlated they could be.”

He also said “What we ended up doing was a distraction from one of unbelievably important area that we completely failed on – that was Risk. That was Risk Management – Customer position risk (#3), conflict of interest risk (#5).”

Investors should realize that Risk adjusted return is more important than the Highest return at any risk. While you appear to be becoming rich faster with multiple highly risky decisions, you could lose everything in just one wrong decision or an error.

Risk Management is the most important aspects of wealth management and is like describing a whole elephant (by an advisor) rather than six blind persons describing one part of an elephant (investment products sold by respective agents).

Investors should have clear understanding of risk and return. Higher the risk, higher the return. As diversification reduces risk, investors should expect lower return from diversified portfolios. If expected return from equity mutual fund is 12%, expected return from direct equity (shares), PMS and AIF should be 14%+, 16%+ and 18%+ respectively. And any PMS giving less than 16% return should be rejected in favor of a mutual fund giving 12% return. Similarly, net of expenses after-tax return should be considered instead of a gross return.

3. Margin Trading / Borrowed funds

Sam said “Most of the firms had borrowed and most of the firms had margin positions. The problem was that it was too big (for Almeda and FTX)”

Borrowing or Margin trading always starts small, at a fraction and then before you know it, snowballed to a position that you cannot control. The incremental position is so small that it is not recognized as a problem until it is too late.

An investor should avoid investing from borrowed funds to get rich faster. However, if a situation arises that requires temporary borrowing; investors should have a hard stop at whatever the cost, situation or circumstances over certain levels (e.g. 10% or 20%).

Investors should accept that it is okay to becoming wealthy slowly. When Jeff Bezos, the founder of Amazon, asked Warren Buffett “Warren, your investment thesis is so simple, and yet so brilliant. Why doesn’t everyone just copy you?” Warren Buffett simply replied “Because nobody wants to get rich slow”.

4. Wasteful spending and ignoring Accounting and administration

SBF said that they “misaccounted” $8B as the FTX’s internal accounting system double-counted $8B customers wired to Almeda to both the fund (Almeda) and the exchange (FTX). However, in reality, the billions of dollars were gone to the limitless spending. SBF later realized that he paid so little attention to his expenses that he didn’t realize he was spending more than he was taking in.

Keeping tab on expenses, managing cash flow and proper accounting are extremely important. Every investor should know and prepare personal profit & loss, cash flow and balance sheet to understand the family’s finances and plan accordingly.

5. Conflict of Interest

SBF and his friends ran a successful crypto hedge fund, Alameda Research which made millions. Then, they started FTX, a Cryptocurrency exchange by having their own firm Alameda providing liquidity for the exchange.

Additionally, FTX created its own crypto currency, FTT, wherein Almeda invested heavily. Almeda gave FTT as security to FTX for margin trading and Alameda was allowed to trade at significantly lower margin than other brokers. Also, instead of admitting mistakes at Alameda, FTX’s customers’ money was transferred to Almeda. And, $8B of such funds were considered as their own by Almeda as well as by FTX due to “misaccounting”.

Just 8 days after a CoinDesk report that highlighted conflict of interest, FTX filed for bankruptcy on Nov 11.

Conflict of interest is THE MOST CRITICAL risk which is being ignored by the investors. With hundreds of thousands of agents, brokers, distributors, finfluencers having their own interests as primary (by definition, by law and in reality) giving “advice”, investors are at a losing end. REMEMBER, if you are not paying for the service, you are the product (being sold).

What an investor needs is NO CONFLICT OF INTEREST in investment advice, which only a SEBI Registered Investment Advisor can provide. Alas, there are only 1349 RIAs as on Dec 16, 2022. https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=13.

Summary:

SBF was a star who shared the stage with past presidents and prime ministers and had support of numerous well known and acclaimed personalities from sports, movies, politics as well as the investment community.

He was a champion of effective altruism- earning money to give it all away. He was a genius having been educated from MIT and was making millions. He started FTX where venture capitalists and investors lined up to invest and once was worth $26Billion. And, he lost everything in a very shor time because of corporate mis-governance, complete disregard to risk management, wasteful spending and margin trading, reasons not considered important by average investors.

The FTX collapse proves, once again, the importance of basic investment principles- avoiding conflict of interest, risk adjusted return, controlling expenses, limiting borrowings as well as sound accounting and tax planning.

However, as the German philosopher Georg Hegel famously said “The only thing we learn from history is that we learn nothing from history.”

Average investor will be making the same mistake. What about you? Are you willing to change? To work with SEBI Registered Investment Advisor?

Please share and comment. Please contact us if you have any questions.

Sources:

https://www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-trading-titan-alamedas-balance-sheet/

https://www.coindesk.com/ftx-news-coverage/

https://www.firstcitizensgroup.com/bb/2022/11/22/the-fall-of-the-ftx-cryptocurrency-exchange-and-the-impact-on-the-industry/

https://interestingengineering.com/culture/26-billion-sam-bankman-fried-now-has-100000

https://edition.cnn.com/2022/11/09/business/sam-bankman-fried-wealth-ftx-ctrp/index.html

https://www.afr.com/technology/inside-sam-bankman-fried-s-bahamian-penthouse-after-the-ftx-collapse-20221205-p5c3nr

https://www.dailyo.in/amp/technology/cypto-king-sam-bankman-fried-arrested-in-bahamas-for-fraud-after-ftx-collapse-38229

About Neuron Wealth Advisors LLP

Neuron Wealth Advisors LLP (NWA) is a SEBI Registered Investment Advisory Firm. We provide holistic advice on Investments, Taxation and Wealth Management so our clients can protect, grow, maintain, manage and sustain wealth for multiple generations. We help our clients simplify their financial life by making informed decisions, optimizing taxes, creating and sustaining wealth, and making smooth and efficient transfer of wealth to next generations while complying with applicable laws.