NeuronWealth Investment Advisory Services: Where Life Goals Come Before Numbers

We believe “Money is for us and We are not for the Money”. It is the duty of Money to serve us, work for us and let us do whatever we want to do in life for the benefit of our past, current and future family.

Investment Advisory is the professional asset advisory services of various securities, including equity shares, bonds, and other assets to meet specified investment goals for the benefit of the family.

Our Investment advisory takes a more holistic view of a client's financial life and includes managing financial assets and other investments through asset management strategies and includes creating a plan - acquiring and disposing of assets, executing the plan - buy and sell of securities, monitoring investments regularly and updating the plan for achieving the life goals.

Looking for a Return to India Investment Advisor?

Planning to return to India and need an investment advisor? Neuron Wealth Advisors in Ahmedabad helps NRIs smoothly transition back, covering bank account conversions (NRE/NRO resident or RFC), tax strategy under FEMA, DTAA, and compliance with SEBI‑registered guidance. We build personalised plans for mutual funds, fixed deposits, real estate, and global assets, aiming to maximise risk‑adjusted after‑tax returns. Our team (CA, CPA, CFA) simplifies cross‑border asset transfers, tax filings, and KYC updates - providing clear, expert support for NRIs re‑establishing in India.

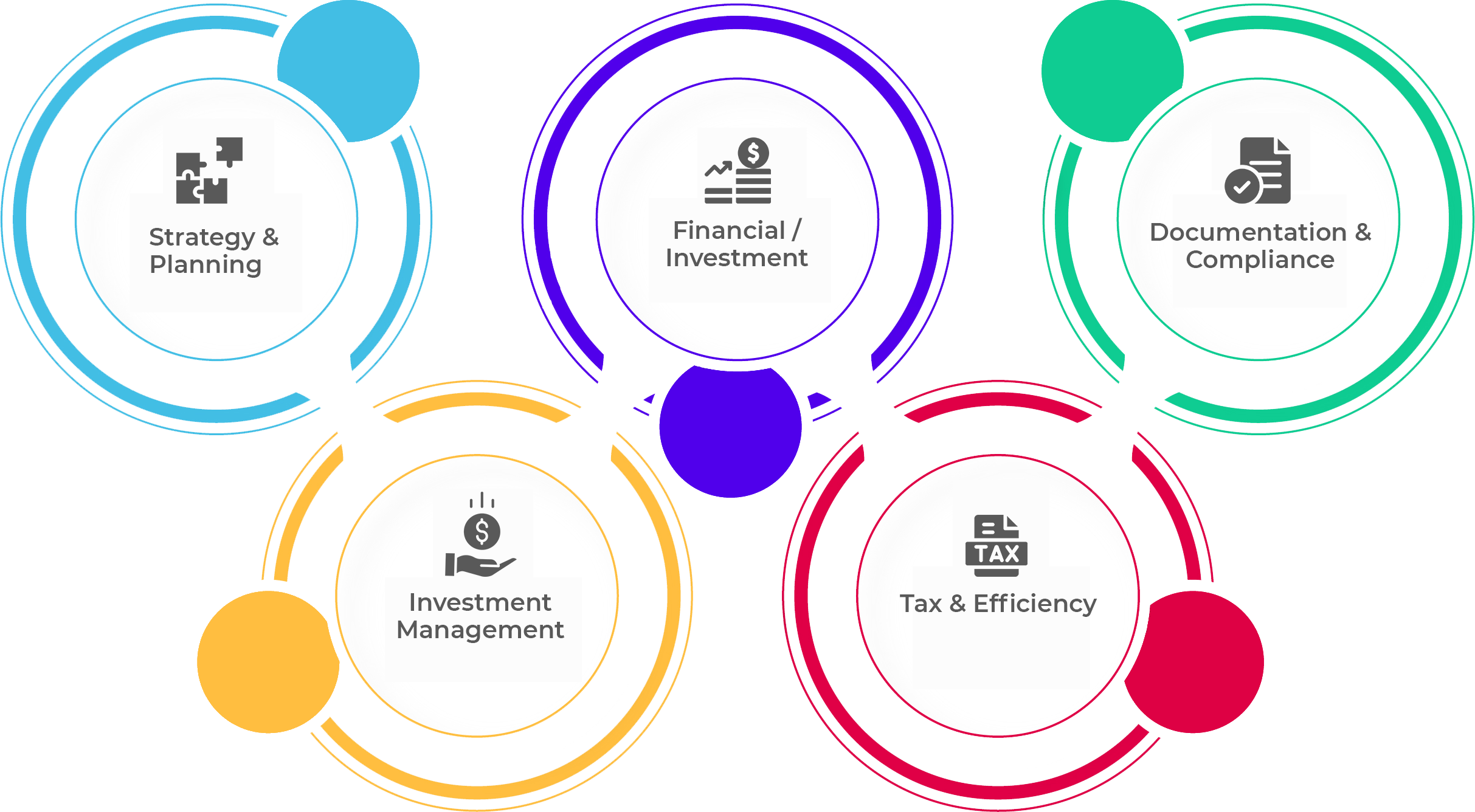

Neuron Wealth offers a one‑stop, SEBI‑compliant solution to ease financial repatriation, ensure legal compliance, and help grow your wealth wisely with our customized investment management strategy that is unique for the family, we help clients not only to make money but also to create everlasting wealth to achieve life goals and improve financial well being. As a part of Investment Management, we provide the following services:

- Bank Accounts & Money Transfers:

- Risk Assessment and Profiling

- Investment Policy Statement (IPS)

- Strategic Asset Allocation & Tactical Asset Allocation

- Global Multi Asset Portfolio Guidance

- Holistic Investment Advice

- Goal based Investments

- Investment Policy Statement (IPS)

- Investment Plan execution

- Monitoring & Reporting

- Financial Decisions:

- PE, VC, Startup Investing

- PMS, AIF and Structured Investment Guidance

- Currency investment, including Crypto / Virtual Currency, etc.

- GIFT City & International Investments

- Family Tax Optimization

- Multi Country Tax Planning

- DTAA benefits & TDS

- Multi-country Residency & Investments

- Bank Account & Money Transfers

- Documentation & Record Management

- FEMA and Income Tax Act

- FATCA/ CRS & global Compliance

- AML and Benami Transaction Guidance